Best Loan Apps without CRB Check in Kenya – Apply Now, Instant Credit

Struggling with financial difficulties? Especially during these times when the economy is down and the cost of living going up due to inflation in the prices of basic commodities.

Have you thought of getting a loan to help with your financial demands? Many have the psyche of going for a loan but give up when they think of the application process, the requirements including your individual credit record. Don’t worry anymore since there are Kenyan loan Apps that can grant you a loan even without checking your CRB record. That means that you can get a loan from the apps even without having them to check your earlier records. However, personal details are compulsory. Let’s get started.

Kenya Loan Apps without CRB Check

Some of the loan apps that provide loans to customers without CRB check include;

- Tala

- Zenka

- M-fanisi

- Utajiri loan app

- Upazi loan app

- Okash

- Branch loan

- Opesa

- Fadhili loan app

The two main ones are Tala and Zenka. Let’s discuss how to go about some of these loan apps; registration, application, and repayment process.

Apply for Tala Loan without worrying about CRB Check

Tala is among the pioneers when it comes to MPESA loan apps in Kenya and it has saved millions of Kenyans during emergencies.

- First, what do you need to qualify for a Tala loan? Well, you have to first download the Tala App via the Play store and then sign up.

- There is a straightforward procedure to follow when applying (after signing up).

How to apply for Tala loan

- Open your Tala app and Click on Apply loan. Type your PIN if needed.

- The Tala loan app form loads on your phone’s screen. Again, enter the necessary information honestly including how you’ll be using the loaned amount.

- Click Next after each step until you’re through.

- Review your answers and Edit if you want to amend any section. Otherwise, click Continue

- Soon a screen loads informing you of how much Tala has approved as your loan. You can click on Choose a loan amount to borrow a lesser amount.

- Click Choose when to repay to specify your most convenient Tala loan repayment period (30/21 days). The service fee will also be indicated appropriately.

- Click to select whichever option you prefer then click Accept.

If you wish to withdraw the amount, just walk into your nearest MPESA agent and make an immediate withdrawal.

The good thing about Tala is that loans are approved pretty fast, within seconds. However, the best part in Tala is that you qualify for a bigger amount when you repay on time. Your limit can even be doubled in just a few months.

Repaying Tala Loan

Let’s now look at the Tala loan repayment process.

Tala loan can be paid either through MPESA or through the Tala App.

Using MPESA

Tala Paybill Number is 851900

Using Tala Loan App

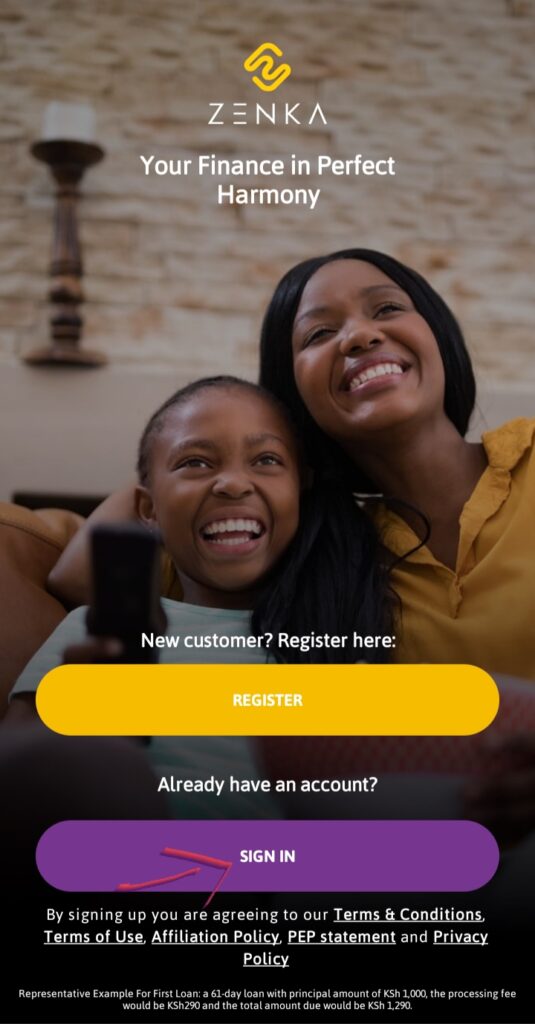

Use Zenka App for Loan without CRB Check In Kenya

Zenka is also a very popular loan app in Kenya. They also do not check your credit records before granting you a loan.

- You only need to download the app from Google Playstore and install in your mobile phone.

After downloading, go ahead and choose the amount you want to borrow and then sign up.

- Open the Zenka app.

- Press ‘sign in‘

- Confirm the mobile number then press next.

- Key in your 4-digit PIN and press sign in.

- You will see how much money you qualify for and the number of days to repay.

- Press ‘Apply now‘

- Confirm the loan summary details which include ‘Total amount‘, ‘Due date‘, ‘Next repayment‘, ‘number of instalments‘, and ‘principal‘.

- Select ‘GET LOAN‘.

- Next, your application will be reviewed.

- You will then receive an SMS from Zenka SMS number 40730 informing you that your loan is being processed.

- Finally, your loan will be sent to you through m-pesa. This takes about 5 minutes.

Zenka loan repayment

To repay Zenka loan via USSD, follow these steps;

- Dial the *841# on your phone

- You will be prompted to enter your secret 4-digit PIN.

- Select the “Repay” menu option; your current loan balance will be displayed.

- Follow the system user prompts to complete the payment

- You will then receive an SMS notification, and your loan will be closed.

Zenka Loan Penalty for late repayment

Zenka loanee should be informed that a one per cent penalty rate from the outstanding principal will be applied per each day of delay. It is important to repay the loan timely so that credit history is not negatively affected.

Zenka Contacts

If you have any queries, you can always reach out to Zenka through the following contacts;

Phone: 254207650878

E-mail: support@zenka.co.ke

Website: zenka.co.ke

Twitter: @ZenkaFinance

Important

| Tala Loan App | Download Now |

| Zenka Loan App | Download Now |

| Best Loan Apps in Kenya | Find out Now |