KRA Tax Compliance Certificate, Online Application, Verify TCC

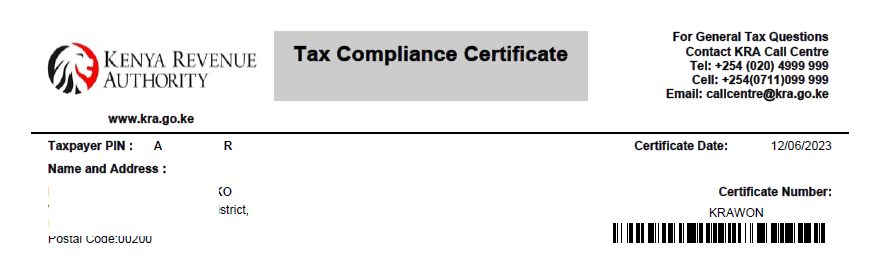

The KRA tax compliance certificate is a document issued by KRA to individuals or Companies to indicate that they have been filling tax returns on time.

A tax compliance certificate is a requirement by Chapter Six of the Kenyan constitution when applying for a job or a tender. Most people ignore getting a TCC without knowing the impact possessed by that simple paper.

Generally, tax compliance certificates go for 1 year (twelve months) before they expire. Before renewing the TCC, you will need to file your tax returns first.

This article explains the step by step of how you can apply for a KRA tax compliance certificate in 2024.

KRA Tax Compliance Certificate Online Application

For the KRA tax compliance certificate online application, you will need the following:

- A computer or a smartphone

- KRA pin

- Stable internet

Once you have the above documents, proceed to fill out the Tax compliance certificate application form Kenya online

- Open a new Google tab

- Search for the KRA portal

- Enter your KRA pin

- Click Continue

- Enter your password

- Solve the arithmetic equation

- Click Log in

- Once the KRA dashboard opens, proceed to the “Certificates” tab and hover over with your mouse.

- Click on “Apply for Tax Compliance Certificate (TCC)”

- Confirm if the details are truly yours and click submit

- Your TCC will be immediately generated

If you have pending penalties, I’m sorry but you won’t be able to get your TCC

You can go ahead and print your KRA Tax compliance certificate

KRA Tax Compliance Certificate Checker

A tax compliance checker was launched by KRA to verify TCC. Since getting Compliance wasn’t easy, people started faking the documents to get jobs and tenders. KRA in turn launched the service to confirm the validity of TCC.

Here are some ways you can check the validity of a Tax compliance certificate in Kenya

- Open the KRA portal

- On the iTax online eServices, select TCC/Exemption Checker

- Select type of certificate (TCC)

- Enter certificate number

- Complete the security stamp

- Click Verify

If the certificate is valid, the system will display all the details of the TCC.

Areas where you need Tax Compliance Certificate

- When applying for a job in the public or private sector

- When applying for a tender, be it in a state corporation or a private institution

- When renewing your work permit

- When applying for clearing and forwarding license

- When applying for a liquor store license

Before applying for a Tax compliance certificate, ensure you`re compliant with the following:

- You file tax returns before the deadline every year

- You have paid all the tax

- You have cleared your outstanding fines and penalties

Do Read – How to Report Tax Frauds in Kenya

Conclusion

The KRA Tax Compliance Certificate is a crucial document. Without TCC, you can’t apply for most of the lucrative jobs advertised, you can’t apply for tenders and you can’t get a liquor license.

The TCC is a small document that people look down upon but very important. If you’re planning to get a TCC in 2024, file your returns first and then apply for the certificate. If you have pending fines, pay them and you will be able to apply and get the Tax compliance certificate. For More information related to KRA, head to the KRA Section.

Frequently Asked Questions (FAQs)

How do I get a KRA compliance certificate?

Log into the KRA portal, apply for Tax compliance, and proceed to print it immediately.

How do I check my tax compliance certificate?

You can use the KRA app to check and verify or the TCC checker on the KRA website.

How do I reprint my tax compliance certificate?

Head over to the certificates tab, hover with your mouse, and click on “Consult and reprint TCC”. Enter the certificate serial number and date of the certificate. Click “Consult” to generate and reprint your TCC.

What is the importance of a tax compliance certificate in Kenya?

Tax compliance certificate shows that a person or entity has filed returns on time and can used to get jobs and tenders. It is a requirement in Chapter Six of the Kenyan constitution to have it when applying for jobs or tenders.

How long does it take to get a KRA compliance certificate?

You can take 2 minutes or more than 5 days to get a KRA tax compliance certificate. It all depends if you have been filing returns on time.

How much does it cost to get a KRA certificate?

A KRA certificate is free if you apply for yourself. If you go to cyber cafes or agencies, you will be charged anywhere from Ksh 100 to Ksh 1,000.