KRA Pin Application Secrets in 2024

KRA pin is almost like a second national ID in Kenya. In 2024, you need a KRA pin in almost everything. Some of the areas you need a KRA pin include:

- When doing bank transactions

- When purchasing or transferring properties

- When buying or selling a motor vehicle

- When applying for a job or a tender

- When applying for a passport

- When registering or renewing a business license

In short, you need a KRA pin in 2024. Applying for the PIN takes around 30 minutes. We have a detailed step-by-step process of how you can apply for your KRA pin in 2024

KRA Pin Registration

Applying for a KRA pin certificate is your first step to freedom. You can buy or sell any property or apply for any job or tender. The advantages of having a KRA pin certificate are endless.

Here is what you will need during the KRA pin application:

- A computer or a laptop

- A working email address and phone number

- A valid address

- National ID card

If you have the above documents, follow these steps to get a KRA pin

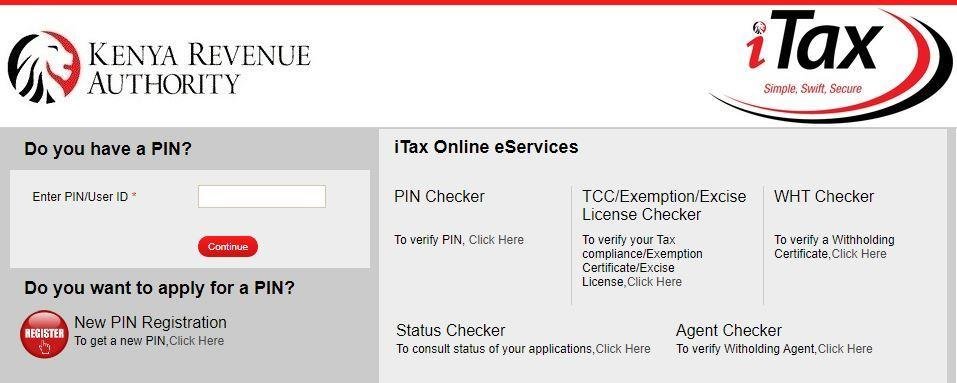

- Open a new Google tab

- Search for KRA iTax

- On the KRA portal, navigate to Pin registration

- On the taxpayer type, select the individual

- Mode of registration choose the online form

- Click next

You will be ushered into the KRA application portal with four sections

Section A: Basic Information

- On citizenship, choose Kenyan

- Scroll down to National ID details

- Enter your ID number

- Scroll down to individual data, enter your date of birth

- Click anywhere on the form to update your details

- If you enter the correct ID number and date of birth, all your details and parents details will automatically appear to fill the blank spaces

- Fill in the employee’s profession and proceed to the physical details

- Enter the L.R number (if it is available, it’s not a must)

- Enter the street road followed by the building name

- Choose your current county from the drop-down menu and enter your town name

- Choose your tax area locality (where you currently live)

- You can describe your address but it’s not a must

- Enter the postal office box

- Enter your Postal code and the postal town will appear automatically to fill the blank box

- Enter your mobile number

- Enter your email address

- A code will be sent to the provided email, enter the code on the KRA portal

- You can go ahead to subscribe to the SMS notification

- Accept the data privacy

- Proceed to fill alternate address if you have any

- Fill your bank details if you have

- Choose yes or No in the director or trustee of any entity section

- Choose No on the tributary bonds section

- Upload any supporting document if necessary

- Click next

Section B: Obligation Details

- Tick on income tax resident box

- Enter today’s date

- If you have any PAYE, rent income, or VAT, you can also tick the boxes.

NOTE: if you don’t have any other income, tick on income tax resident ONLY.

Click next

Section C: Sources of Income

If you have no source of income, choose NO on all three options which include

- Employment income

- Rental income

- Business income

If you’re employed, tick on the employment income and enter your employer’s KRA pin.

Section E: Agent Details

Don’t touch this area if you’re not an agent

Proceed to the last step and enter the arithmetic equation

Click submit

Download your KRA Pin certificate

Don’t forget to file your returns in 2025. If you lose your PIN, use the KRA pin checker to recover your PIN.

Conclusion

In 2024, you need a KRA pin certificate in almost all sectors in Kenya. Applying for a job or a passport requires you to have a PIN. Additionally, you can’t purchase or sell property in Kenya without the KRA certificate.

To avoid limiting yourself and missing out on opportunities, ensure you apply for a KRA pin and file your tax returns before the government financial year ends on 30th June.

Frequently Asked Questions (FAQs)

How do I recover my KRA password?

Click forgot password on the KRA portal, complete the arithmetic equation, and hit submit. Your new KRA password will be sent to your email address.

Where can I download the KRA PIN?

The KRA iTax portal is the only place you can download your KRA PIN

How do I check my KRA status?

To check your status, log in to your KRA portal. Under Status Checker, click to check your application status.

How do I log into my KRA portal?

Visit the KRA portal, enter your PIN, enter your password, solve the arithmetic equation, and log into your account.

How can I get my KRA PIN by SMS?

You can’t get your KRA PIN through SMS due to security reasons. The only way to get your KRA portal is through the email address or the KRA portal.

How do I recover my KRA PIN by email?

Scan your National ID on both sides and send it to callcentre@kra.go.ke explain your case and indicate the email address where your KRA pin will be sent. Once your pin is sent via email, you can use the KRA pin checker to confirm your details.

What happens when you lose your KRA PIN?

You won’t be able to purchase or transfer properties and cars. KRA Pin is needed when doing transactions in the bank or any financial institutions

How do I renew my KRA PIN?

You can amend your PIN details by visiting the KRA portal and amending the information. You amend PIN details when you move to a new address, or location or change your job.