P9 Form for Public Servants/Teachers : Download, File Returns

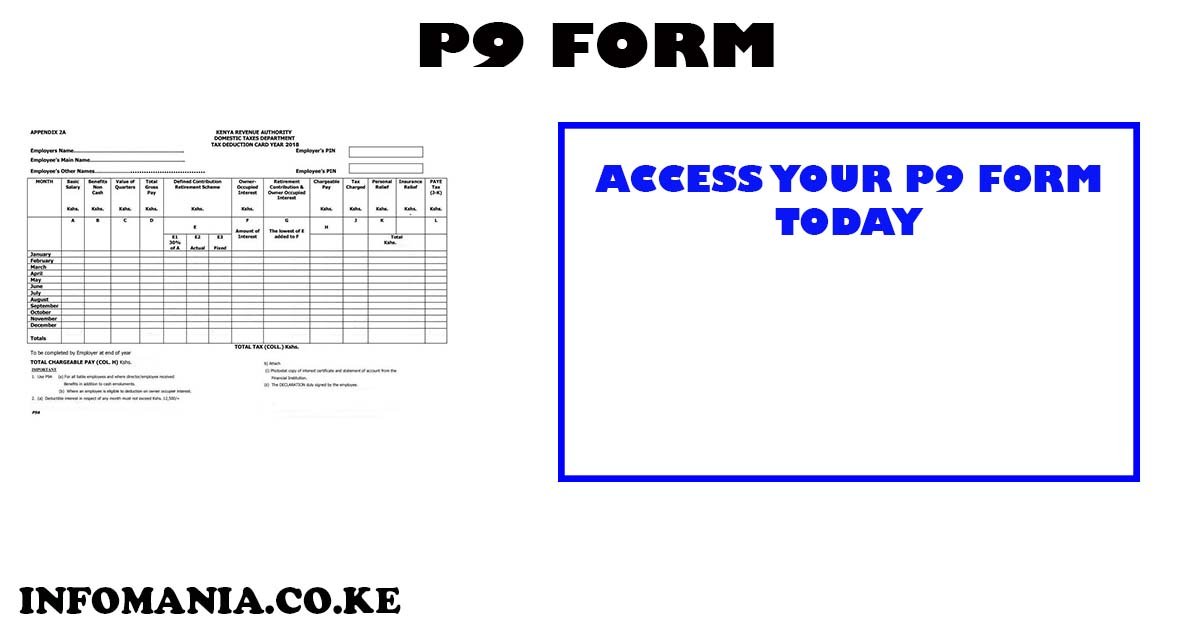

A P9 form is a type of certificate that is issued by employers to employees in Kenya. The P9 form includes the total amount earned in that year, total deductions, PAYE amount, tax relief, and employer and employee KRA pin.

You need a P9 form if you’re employed and want to file your KRA returns in 2024. You can also be able to file returns without P9 form but the records will have few errors. For a clean record on your KRA portal ledger, you need to have a p9 form.

So, where can you get this P9 form? We have included everything you need to do to get the P9 form in this article.

P9 Form Download

There are several ways you can use to access the P9 form in Kenya. The ways can be divided into the following groups:

- Public servants

- Private sector employees

- Teachers

The above groups get their P9 form from different sources.

For employees in the private sector, you can get your P9 form from your HR manager or it can be sent to your email address

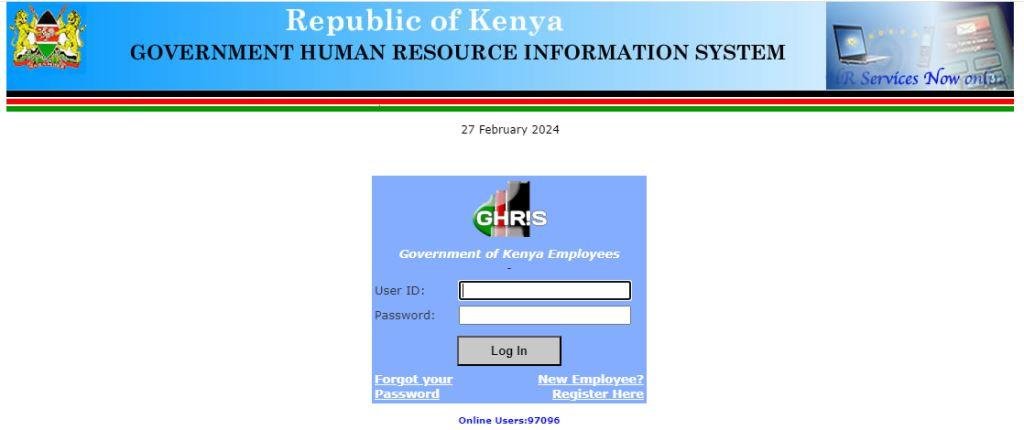

P9 form from GHRIS

The GHRIS p9 form is for public servants, ranging from the police force to state corporation employees.

To get the public service payroll p9 form, follow the steps below:

NOTE: This process is for GHRIS p9 form download

- Visit the GHRIS portal

- Enter user ID

- Enter password

- Click Log in

- Once the GHRIS dashboard opens, click the records tab and go straight to the P9 form

- Select the P9 form you want to view

- Download it or print it.

P9 Form for Teachers

To get p9 forms for teachers, follow the steps below:

- Visit the TSC Tpay portal

- Enter your TSC number or your ID number

- Enter your password

- Click login

- On the Tpay dashboard, click P9

- Your P9 form will be displayed

- Download and print it.

How to file returns using the p9 form

You will need the KRA p9 form and the Excel sheet from the KRA portal to file your returns. First download the p9 form from GHRIS, email address, or wherever it was sent.

- Log into the KRA portal

- Download the Excel form

- Fill in your details and employer details

- Indicate how much you earned in that year and the deductions

- Validate your form

- Upload it to the KRA portal

- Submit it and download your tax return receipt

Conclusion

The P9 form is a crucial form when filling out your KRA returns annually. The P9 indicates how much you earned in that year and the deductions from your salary.

If you want to file your tax returns in 2024, you will need the P9 form. You can download P9 from GHRIS if you’re a public servant or get it from the “human resource manager” if you are in the private sector.

Frequently Asked Questions (FAQs)

How do I get my P9 form?

If you work in the private sector, you can ask for your P9 form from your employer physically. If you’re a public servant, you can get your P9 from from GHRIS website. Teachers can access their P9 forms from the TSC website

What is the meaning of the P9 form?

A P9 form is a tax deduction form issued by every employer in Kenya indicating the amount earned and the tax deducted from a particular employee in that financial year.

How do I file a P9 return online?

To file your P9 returns, visit the KRA portal, enter your PIN and password, download the Excel form, and fill and upload it to the website. After submitting the Excel form, download your receipt that indicates that you have filled your KRA P9 returns

How do I get a P9 form for the police?

Visit the GHRIS portal enter your user ID and password, log in, and download your P9 form from the records tab.